Never heard Bill Clinton say that, but it was James Carville's standard line during the 1992 campaign. Carville, along with Paul Begala, ran the campaign.

IMHO, where the H got trampled outside the Palm Beach County election center in 2000, 2020 will be a very "personal" election. With Trump, we now know what we got -- totally different from any other president (although I was pretty young when James Buchanan and Andrew Johnson were in the White House). The question is whether the American people will sign up for four more years of it.

Results 741 to 760 of 26103

Thread: 2020 Presidential Election

-

04-10-2019, 09:43 AM #741

Member

Member

- Join Date

- Dec 2009

- Location

- North of Durham

Interesting article on the divide in the Democratic Party and the issues around playing to the left end of the party vs. the center, both in terms of the primary and the general election.

https://www.nytimes.com/2019/04/10/o...gtype=Homepage

-

04-10-2019, 10:24 PM #742Sage Grouse

---------------------------------------

'When I got on the bus for my first road game at Duke, I saw that every player was carrying textbooks or laptops. I coached in the SEC for 25 years, and I had never seen that before, not even once.' - David Cutcliffe to Duke alumni in Washington, DC, June 2013

-

04-10-2019, 10:38 PM #743

-

04-10-2019, 10:57 PM #744

-

04-11-2019, 07:31 AM #745

Member

Member

- Join Date

- Feb 2010

On the Dem nominating schedule: http://crystalball.centerforpolitics...e-a-long-slog/

Didn't realize a candidate must get 15% of the vote to be awarded delegates in any caucus or primary.

-

04-11-2019, 08:19 AM #746

-

04-11-2019, 09:28 AM #747

Member

Member

- Join Date

- Feb 2010

-

04-11-2019, 11:05 AM #748

Member

Member

- Join Date

- Nov 2007

-

04-11-2019, 11:11 AM #749

Member

Member

- Join Date

- Nov 2007

-

04-11-2019, 11:56 AM #750

-

04-11-2019, 12:38 PM #751

-

04-11-2019, 01:56 PM #752

Member

Member

- Join Date

- Dec 2009

- Location

- North of Durham

My current employer (financial services) vested immediately, but match didn't start for a year (6% match). My prior employer (also financial services) had a 20% per year vest on their match (5% match). At both places your own contribution was yours immediately.

At my prior employer I had a colleague who was late-50s, MBA from a top 4 business school, 30 years in financial services. He had been quite successful, gotten laid off in his mid-50s, landed working with me at a lower pay and title level, but still doing fine. Through various conversations I knew that he had been pretty good about saving for retirement, college, etc so definitely had some money in the bank, and he didn't live lavishly. After he had been there about two years I asked him about his 401k contribution. He said he didn't make one, as at his new, lower pay level mainly went to living expenses. I told him that he should at least contribute to the level to maximize his match and worst case draw down savings for living expenses as he was leaving tax-free income plus the match on the table. He insisted that his plan was better. I could not understand how he did not understand this concept. Unfortunately, there are many people like that out there.

-

04-11-2019, 06:43 PM #753

Member

Member

- Join Date

- Nov 2007

-

04-11-2019, 06:56 PM #754

Member

Member

- Join Date

- Nov 2007

I sure hope people read and reflect on the very insightful post above!

Someone with a top 4 MBA (which requires financial aptitude) and 30 years industry experience does not understand it's prudent to contribute 6% (dependent on salary) of their income to a 401k and immediately make a 100% guaranteed return (6% match, vested immediately) on their contribution.

Skip Starbucks and save $5 per day on coffee. Invest it for 40 years in a 401k and what do you have if the stock market averages a 10% historic return? $807,700

-

04-11-2019, 07:17 PM #755

Member

Member

- Join Date

- Feb 2007

- Location

- San Diego, California

-

04-12-2019, 10:00 AM #756

Member

Member

- Join Date

- Nov 2007

I disagree with their message and analysis!

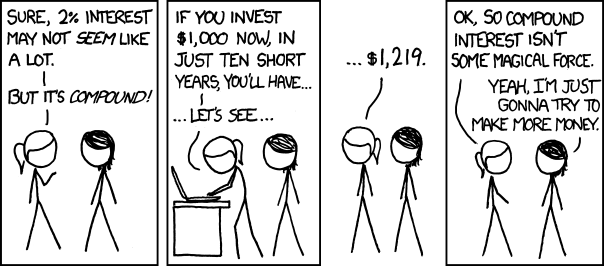

My $5 coffee introduction is a beginning, not an end. It introduces people to the great power of compounding a relatively small amount of money. When I do volunteer work, I introduce this concept and ask people to then track every dollar they spend for the next 30-90 days. Our second meeting usually begins with the person saying, "I can't believe how much money I spend on X and Y". And, there's my opening to spending and savings habits.

-

04-12-2019, 10:17 AM #757

On Holiday

On Holiday

- Join Date

- Feb 2007

-

04-12-2019, 10:29 AM #758

Member

Member

- Join Date

- Dec 2014

- Location

- On the Road to Nowhere

I'd rather have a penny doubled every day for a month.

-

04-12-2019, 11:08 AM #759

Member

Member

- Join Date

- Feb 2007

- Location

- San Diego, California

And you agree with Bach.

I agree ("beginning" is the key).

I love xkcd.

Still, $100 invested in cash (3-month U.S. Treasury bills) in 1928 would be worth $2,063.40 as of January 1, 2019; $100 in bonds (10-year U.S. Treasury notes) would be worth $7,308.65, and $100 in stocks (S&P 500) would be worth $382,850.00.

Me too.

-

04-12-2019, 11:41 AM #760

On Holiday

On Holiday

- Join Date

- Feb 2007

Similar Threads

-

MLB 2020 HOF Election

By Blue in the Face in forum Off TopicReplies: 13Last Post: 01-24-2020, 12:28 PM -

Presidential Inauguration

By such in forum Off TopicReplies: 3Last Post: 11-26-2008, 11:19 AM